Federal Employee Health Insurance After Retirement: Guide

Yes, you absolutely can keep your federal employee health insurance after retirement. This is a huge perk of a federal career. Unlike most private-sector jobs where health insurance vanishes when you stop working, the Federal Employees Health Benefits (FEHB) program is designed to stick with you for life.

Keeping Your FEHB Health Insurance After You Retire

Health insurance is probably one of the biggest question marks you have about retirement. For federal employees, the answer is reassuring. You don't get thrown into the individual insurance market to fend for yourself. You get to keep your FEHB plan, which is a massive relief. For a deeper dive into how FEHB stacks up, you can explore comparisons on fedimpact.com.

Think of it this way: your long-term service as a federal employee earns you a lifelong health benefit. But it's not an automatic guarantee for everyone. You have to meet a few key requirements set by the Office of Personnel Management (OPM) to make it happen.

The Bedrock Rule for Eligibility

Everything boils down to one simple, non-negotiable principle: the "5-Year Rule." If you want to carry your FEHB coverage into retirement, this is the one requirement you absolutely must meet. It just means you have to be continuously enrolled in an FEHB plan for the five years leading right up to your retirement date.

The government put this rule in place to make sure this valuable benefit is for career employees, not for someone who might try to enroll right before they retire just to get coverage for life.

Good news: "continuous coverage" doesn't mean you have to stay in the exact same plan for five years. You can switch carriers every Open Season, as long as you never had a break in your FEHB enrollment.

What This Guide Covers

Trying to figure all this out can feel like a chore, but we’re here to give you a clear roadmap. We'll walk through everything you need to know about keeping your federal health insurance after you retire.

By the end, you'll have a solid handle on:

- Eligibility Rules: We'll dig into the details of the 5-Year Rule and the immediate annuity requirement.

- Medicare Integration: You'll learn how FEHB and Medicare coordinate to give you incredibly comprehensive coverage.

- Managing Costs: We'll give you a realistic look at what to expect for premiums and other out-of-pocket expenses.

- Making Smart Choices: You'll see how to use Open Season to your advantage and adjust your plan as your needs change over time.

This guide will give you the confidence to transition into retirement knowing your health benefits are secure. Once you get these core concepts down, you'll be in a great position to protect your health and finances for years to come.

Qualifying to Keep Your FEHB Health Benefits in Retirement

One of the biggest questions federal employees have as they approach retirement is, "Can I keep my health insurance?" The short answer is yes, but it's not automatic. You need to meet a couple of key requirements set by the Office of Personnel Management (OPM).

Think of it like this: your Federal Employees Health Benefits (FEHB) are a cornerstone of your retirement package, but you have to make sure the foundation is solid before you leave. Let's walk through the two non-negotiable rules you must satisfy to carry your FEHB coverage into retirement.

The 5-Year Continuous Enrollment Rule

The first and most important rule is what everyone calls the "5-Year Rule." It’s pretty straightforward: you must be continuously covered by an FEHB plan for the five full years immediately before you retire.

This doesn't mean you had to be in the same plan for all five years. You could have switched from Blue Cross to GEHA to Aetna during Open Season every year. What matters is that you never had a gap in your FEHB coverage during that five-year look-back period.

So, if you’re planning to retire on December 31, 2028, your FEHB enrollment must have been active and unbroken since at least December 31, 2023.

A common point of confusion is whether being covered under your spouse's FEHB plan counts. Good news—it absolutely does. If you were covered as a family member on another federal employee's FEHB plan, that time counts toward your own 5-year requirement.

The Immediate Annuity Requirement

The second piece of the puzzle is that you must retire on an immediate annuity. In simple terms, this means your pension payments have to start within 31 days of your last day of work. If you're eligible for a postponed or deferred retirement, you won't be able to continue your FEHB coverage.

This rule essentially links your health benefits directly to your official retirement status. The government sees FEHB in retirement as a benefit for those who complete their career and immediately start drawing their pension.

To meet this requirement, your retirement must fall into one of these categories:

- Voluntary Retirement: You’ve met the age and service requirements and decide it’s time to go.

- Involuntary Retirement: Your separation is due to something like a reduction-in-force (RIF).

- Disability Retirement: You’ve been approved to retire because a medical condition prevents you from doing your job.

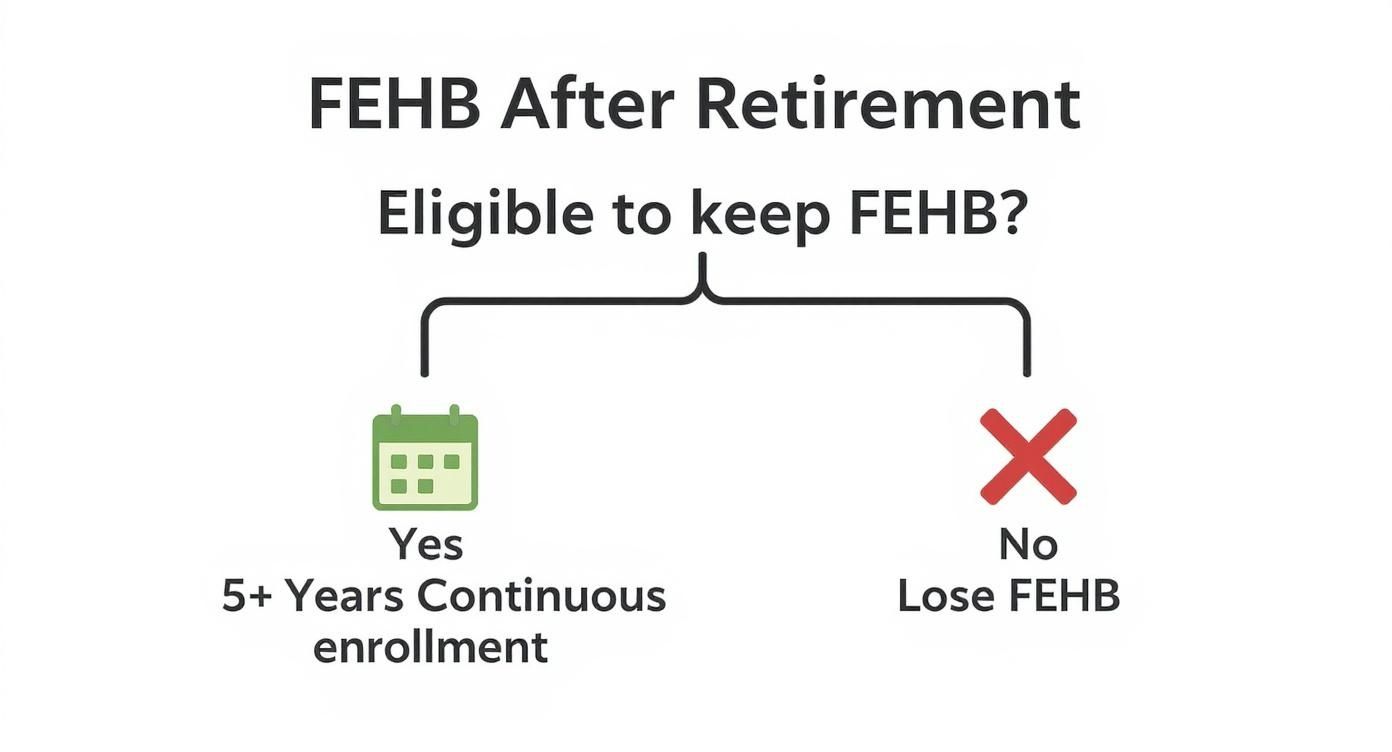

This decision tree gives you a simple visual of how the logic works.

As you can see, that 5-year rule is the main gate you have to pass through to keep your health insurance.

Navigating Common Scenarios and Exceptions

Of course, careers aren't always a straight line, and you might have questions about your specific situation. Let's clear up a few common concerns.

What happens if you had a break in service? If you left federal employment and came back later, the clock on your 5-year requirement likely reset. The rule is about the five continuous years immediately before your final retirement date.

Another tricky area is Leave Without Pay (LWOP). Being on LWOP doesn't automatically break your coverage, but it depends on how long you were out. For short stints, your agency typically keeps you covered and you just pay back the premiums when you return. For longer periods, you may have had to make direct payments to the plan to keep your enrollment active.

Key Takeaway: The single most important thing you can do is check your records. Pull out your SF-50s (Notification of Personnel Action) and confirm your FEHB enrollment dates. Your agency's HR office is your best friend here—they can help you verify that your official record shows at least five continuous years of coverage. Don't leave something this critical to chance.

How FEHB and Medicare Work Together for You

Figuring out how your Federal Employees Health Benefits (FEHB) plan and Medicare coordinate is probably the single most important piece of the retirement puzzle. Get this right, and you can save thousands of dollars and sleep a lot better at night. While it might seem complicated, the concept is actually pretty straightforward once you break it down.

Think of it like having a fantastic tag team on your side. Once you enroll in Medicare, it steps up to become your primary insurance. It’s the first line of defense, tackling your medical bills head-on. Your FEHB plan then smartly shifts into a new role as your secondary insurance, providing incredible backup. It comes in right behind Medicare to pay for costs that Medicare doesn’t cover.

This one-two punch is what makes your coverage so powerful. Medicare pays its portion, and your FEHB plan helps with the rest, often wiping out deductibles, coinsurance, and copayments. This powerful combination is a huge reason why federal employee health insurance after retirement is considered one of the best benefits packages out there.

Why Enrolling in Medicare is a Smart Move

Once you hit 65, you’re eligible for Medicare. For the vast majority of federal retirees, signing up for both Medicare Part A and Part B is a brilliant financial move.

- Medicare Part A (Hospital Insurance): For almost every federal employee, Part A is completely premium-free. You’ve already paid for it through payroll taxes during your career. It’s your coverage for inpatient hospital stays, skilled nursing facility care, hospice, and some home health care.

- Medicare Part B (Medical Insurance): This is your coverage for doctor’s visits, outpatient procedures, lab work, and preventive care. Part B does have a monthly premium, which sometimes makes retirees hesitate. But in nearly every case, the benefits of pairing it with your FEHB plan will far outweigh this cost.

When you have both, your FEHB plan sees that Medicare is paying first. Because of this, many FEHB plans will then waive their own deductibles, copayments, and coinsurance for any service that Medicare covers. The end result? You often get near-total coverage with very little, if anything, to pay out of your own pocket.

By coordinating FEHB with Medicare Part A and B, you essentially create a powerful safety net. Medicare handles the bulk of the costs, and your FEHB plan fills in the gaps, protecting you from the high out-of-pocket costs that can come with major medical events.

A Real-World Example of Coordination

Let's walk through a real-life scenario to see just how this teamwork plays out. Imagine you're retired, enrolled in both an FEHB plan and Medicare Parts A and B, and you have a hospital stay that results in a $20,000 bill.

Here’s how the payment process unfolds, step by step:

- The Bill Goes to Medicare First: The hospital submits the entire $20,000 bill directly to Medicare, because it's your primary insurer.

- Medicare Pays Its Share: Medicare Part A processes the claim. Let's say it approves the charges and pays $18,000, leaving a $2,000 balance. This remainder might be your Medicare deductible or other costs.

- FEHB Steps In: The remaining $2,000 bill is then automatically forwarded to your FEHB plan.

- Your FEHB Plan Covers the Rest: Since Medicare paid first, your FEHB plan will likely cover that remaining $2,000 in full, often waiving the deductibles and copays you'd normally have to pay.

In this situation, your total out-of-pocket cost for a $20,000 hospital visit could be $0. If you only had your FEHB plan without Medicare, you would have been on the hook for your plan's deductible and coinsurance, which could have easily cost you several thousand dollars.

The table below gives you a clearer picture of how this partnership works for different types of healthcare services.

FEHB and Medicare Coordination Roles

| Healthcare Service | Primary Payer (Pays First) | Secondary Payer (Pays Remaining Balance) | Potential Retiree Out-of-Pocket Cost |

|---|---|---|---|

| Doctor's Office Visit | Medicare Part B | Your FEHB Plan | Often $0 |

| Inpatient Hospital Stay | Medicare Part A | Your FEHB Plan | Often $0 |

| Prescription Drugs | Your FEHB Plan | N/A (FEHB acts as your Part D equivalent) | Your FEHB plan's copay/coinsurance |

| Outpatient Surgery | Medicare Part B | Your FEHB Plan | Often $0 |

As you can see, for most medical services, Medicare takes the lead and your FEHB plan provides excellent backup, drastically reducing what you have to pay.

The Added Bonus of Part B Reimbursements

But the benefits don't even stop there. Some FEHB plans offer an incredible perk to make the combination with Medicare even more appealing: they will actually help you pay for your Medicare Part B premium.

Certain plans—often Consumer-Driven Health Plans (CDHPs) or some HMOs—provide a partial reimbursement for your Part B premiums. This usually comes in the form of a credit to a Health Reimbursement Arrangement (HRA) or sometimes a direct reduction. For instance, a plan might offer an $800 reimbursement per person, per year.

This feature makes the decision to enroll in Part B even easier, as it directly lowers your total healthcare spending. When you’re looking at plans during Open Season, it’s a savvy move to look for one that offers a Part B reimbursement to maximize your benefits and minimize your costs. This financial boost can go a long way in offsetting the premium, making your comprehensive federal employee health insurance after retirement even more affordable.

Managing Your Health Insurance Costs in Retirement

Knowing you can keep your health benefits is a huge relief, but figuring out how to pay for them is a different story.While carrying your federal employee health insurance after retirement is a fantastic perk, it's not free. You'll need to get a clear picture of the costs to make sure your budget can handle it without any nasty surprises down the road.

The good news is that the government’s contribution doesn’t stop when you do. Just like during your career, Uncle Sam continues to pay a big chunk of your premium—typically around 70%. Your share is simply deducted from your monthly annuity payment, which is incredibly convenient. No bills to remember, no checks to mail.

But here's the reality check: those premiums don't stay the same forever. Healthcare costs have a habit of climbing year after year, pushed up by new medical technology, more people using services, and the sky-high price of prescription drugs. That trend hits your FEHB premiums directly.

Why Your Premiums Increase Over Time

It’s a safe bet that your share of the premium will inch up annually. This isn't a problem unique to the FEHB program; it's just the reality of the American healthcare system. As the cost of care and medicine goes up, insurance carriers have to charge more to cover everything, and that increase gets passed on to both the government and you.

For instance, we're seeing some of the biggest premium jumps in over a decade. In 2025, the average FEHB premium is slated to rise by a hefty 13.5%. For a retiree with self-only coverage, that could mean an extra $26.10 coming out of each biweekly annuity payment. These hikes can really sting, especially when your pension's cost-of-living adjustment doesn't keep pace. You can learn more about recent FEHB premium changes on fedimpact.com to see the latest numbers.

A smart move is to build a buffer for healthcare inflation right into your retirement budget. Planning for a 5-10% increase in your premiums each year is a realistic way to stay ahead of the curve.

Looking Beyond the Monthly Premium

Your monthly premium is just the starting point. To build a truly realistic budget, you have to think about all the other out-of-pocket expenses that can pop up. These costs are completely different from one plan to another, so understanding them is the key to picking the right one.

Here are the other major costs you need to plan for:

- Annual Deductibles: This is the money you have to spend on medical care before your insurance starts paying its share. Plans with low premiums often have high deductibles.

- Copayments and Coinsurance: A copay is a flat fee you pay for a service, like $30 for a doctor’s visit. Coinsurance is a percentage you pay, like 20% of a hospital bill, after you've met your deductible.

- Medicare Part B Premium: If you enroll in Medicare Part B (and most retirees should), that premium will be a separate cost deducted directly from your Social Security check.

- Out-of-Pocket Maximum: This is your financial safety net. It’s the absolute most you'll have to pay for covered services in one year. Once you hit that number, the plan pays 100%. Knowing this figure helps you budget for a worst-case scenario.

Using Open Season to Control Your Costs

So, with costs always on the rise, how do you keep things manageable? Your most powerful tool is the annual FEHB Open Season. It runs every fall from mid-November to mid-December, and it's your one chance to make changes for the year ahead.

This is not the time to be on autopilot. Treat it as an annual financial check-up. During Open Season, you can:

- Switch to a More Affordable Plan: Compare the premiums, deductibles, and copays of different plans. If you're in good health, a lower-cost plan might be a perfect fit and save you a bundle.

- Find a Plan That Reimburses Part B Premiums: Some FEHB plans offer a partial reimbursement for your Medicare Part B premium. This can put hundreds of dollars a year back into your pocket.

- Adjust Your Coverage Level: Has your family situation changed? Maybe you no longer need a Self and Family plan. Switching to Self Plus One or Self Only could lead to significant savings.

Actively shopping around during Open Season every year is the single best strategy for managing your federal employee health insurance after retirement. By taking the time to reassess your needs and compare your options, you can make sure your coverage works for both your health and your wallet.

How to Make Changes to Your FEHB Plan After Retiring

https://www.youtube.com/embed/YFJhAUFIf3o

One of the best parts about your federal benefits is that your health insurance doesn't just stop when your career does. But it's also not a "set it and forget it" situation. Your life will change in retirement, and thankfully, your Federal Employees Health Benefits (FEHB) plan is built to change right along with you.

If you’re eligible, your FEHB coverage will automatically continue into retirement—no extra paperwork needed right at that moment. The key is understanding when and how you can make adjustments down the road to keep your plan in sync with your life.

There are really two main ways you can change your federal employee health insurance after retirement: the annual Open Season and special Qualifying Life Events. Getting familiar with both is crucial.

Your Annual Opportunity During Open Season

Think of Open Season as your yearly health plan check-up. It happens every year from mid-November to mid-December and it’s your prime opportunity to take a hard look at your coverage and decide if it's still the right fit for the year ahead.

This isn't just for minor tweaks. During this window, you have the freedom to make some pretty significant changes.

Here’s a look at what you can do during Open Season:

- Switch to a new plan or carrier. Maybe another plan now offers better prescription coverage, or you found one with a lower premium. Now is the time to make the switch.

- Change your level of coverage. You can move between Self Only, Self Plus One, and Self and Family plans as your family situation changes.

- Enroll in a plan. If you previously suspended your FEHB coverage (maybe you were using TRICARE), you can jump back in during Open Season.

- Cancel your coverage entirely. It's rarely a good idea, but the option is there if you need it.

This annual event is your most powerful tool for managing your healthcare costs and making sure your plan truly works for you.

Making Changes Outside of Open Season

Of course, life doesn’t always stick to a convenient schedule. Major events happen when they happen. The FEHB program gets this, which is why we have Qualifying Life Events (QLEs).

A QLE is a specific, government-recognized change in your life that lets you adjust your health insurance outside of the annual Open Season.

When a QLE occurs, it opens a special enrollment window, usually from 31 days before to 60 days after the event. This gives you a decent amount of time to get your coverage updated to match your new reality.

Think of a Qualifying Life Event like a special key. It temporarily unlocks the door, allowing you to change your FEHB plan right when you need to, instead of making you wait months for the next Open Season.

So, what exactly counts as a QLE? The list is pretty specific, but it covers most of the big life transitions you’d expect.

Common Qualifying Life Events include:

- Marriage: You can add your new spouse and their eligible children.

- Birth or Adoption: You can enroll your new child.

- Divorce: This event allows you to remove a former spouse from your plan.

- A Spouse Losing Other Coverage: If your spouse loses their health insurance from their own job, you can add them to your FEHB plan.

- Moving: If you’re in an HMO and you move out of its service area, you can choose a new plan that covers you in your new location.

- Becoming Eligible for Medicare: This is a big one for retirees. It’s a QLE that allows you to make changes to your FEHB plan as you start coordinating it with Medicare.

Understanding these two different paths—the routine annual check-up of Open Season and the as-needed adjustments from QLEs—is what will keep your health plan perfectly aligned with your needs, protecting both your health and your wallet for years to come.

Unique Health Insurance Rules for Postal Retirees

If you're a United States Postal Service employee or retiree, your journey with federal employee health insurance after retirement is heading down a new track. The familiar Federal Employees Health Benefits (FEHB) program is being phased out for postal workers and replaced by a brand-new, separate system built just for you: the Postal Service Health Benefits (PSHB) program.

This isn't just a simple name change. It fundamentally reshapes how your health insurance functions, particularly in its relationship with Medicare. The most critical change is a new, mandatory requirement for most postal retirees to enroll in Medicare Part B.

The Mandatory Medicare Part B Requirement

Under the new PSHB program, once you and your covered family members are eligible for Medicare, you must enroll in Medicare Part B to continue your PSHB coverage. If you don't sign up for Part B during your initial eligibility window, you could lose your postal health insurance for good.

This is a major departure from the old FEHB system, where enrolling in Part B was always a smart move but never a requirement. For postal retirees, it's now a non-negotiable part of the deal.

However, there's one very important exception to keep in mind:

Postal annuitants who retired on or before January 1, 2025, are not required to enroll in Medicare Part B to keep their PSHB coverage. This "grandfather" clause protects those who retired under the old rules.

This new system is part of a larger strategy to more tightly weave postal retiree healthcare with Medicare. As you can see, the landscape of federal employee health insurance after retirement is changing, and USPS retirees are at the center of it. You can get more details about these 2025 federal benefit changes on psretirement.com.

Integrated Prescription Drug Coverage

Another key piece of this puzzle is how prescription drugs are handled. All PSHB plans will now automatically include Medicare Part D prescription drug coverage. This is a big shift from the FEHB world, where your plan's drug benefit was merely considered "creditable," meaning it was at least as good as a standard Part D plan.

So, what does this integration mean for you in practical terms?

- No More Guesswork: You won't have to shop for or enroll in a separate Part D plan. Your prescription benefits are built right into your PSHB plan.

- One-Stop Shop: Your PSHB plan becomes your comprehensive health and drug plan, working hand-in-glove with Medicare Parts A and B.

Getting a handle on these new rules is crucial to protecting your health benefits into the future. With the PSHB program rolling out, understanding your Medicare obligations has never been more important.

Answering Your Top Questions About Retiree Health Benefits

When you're planning for retirement, the details around your health insurance can get confusing. Let's tackle some of the most common questions federal employees have about their benefits after they leave service.

Can I Put My FEHB on Hold to Use TRICARE Instead?

Yes, absolutely. If you have coverage under another qualified plan, like TRICARE or even a spouse's private plan, you can suspend your FEHB enrollment. This is a much smarter move than flat-out canceling it.

Think of suspending as pressing the pause button. It stops your premium payments but keeps the door open for you to come back later. You can re-enroll during the annual Open Season or if you happen to lose that other coverage unexpectedly. It’s a great way to save money on premiums without giving up your valuable, hard-earned FEHB eligibility for good.

Key Insight: Suspending your FEHB coverage isn't a permanent goodbye. It's a strategic pause that protects your right to re-enroll later, giving you a critical safety net if your circumstances change.

What Happens to My Family’s Coverage if I Die?

This is a crucial question. If you have a Self Plus One or Self and Family plan, your family's health coverage doesn't have to end when your life does. The key is the survivor annuity.

For your family to keep their FEHB coverage, you must have chosen to provide a survivor annuity when you filled out your retirement paperwork. As long as that's in place, the government continues to pay its portion of the premiums, and your survivor’s share is simply deducted from their monthly annuity check. This is a powerful feature that provides real peace of mind and lasting security for your loved ones.

Do I Need Medicare Part D if I Have an FEHB Plan?

For most federal retirees, the answer is a clear no. Signing up for a separate Medicare Part D plan is usually redundant and an unnecessary expense.

Here’s why: Every single FEHB plan already includes "creditable" prescription drug coverage. That’s a technical way of saying the drug benefits in your FEHB plan are at least as good as, if not better than, a standard Part D plan. Paying for Part D on top of that would be like paying for two prescriptions to solve the same problem. You'd just be paying an extra premium for benefits you already have.

Getting these rules right is essential for a worry-free retirement. Federal Benefits Sherpa can help you sort through the complexities. We offer a free 15-minute benefit review to make sure you're set up for success.