A Guide to the Minimum Retirement Age for Federal Employees

When people talk about the minimum retirement age for federal employees, they're not talking about one single number. It’s actually a sliding scale that lands somewhere between age 55 and 57, all depending on the year you were born.

This age is your MRA, and it's a critical date on your calendar. It marks the earliest point you can retire under the Federal Employees' Retirement System (FERS) and receive an immediate, full pension—as long as you’ve also put in the required years of service.

What Is the Minimum Retirement Age for Federal Employees

Think of your Minimum Retirement Age (MRA) as the official starting line for your federal retirement journey. It’s the first major milestone that unlocks different retirement pathways, each with its own set of rules and financial implications. Knowing this date is the bedrock of a solid, stress-free plan to transition out of federal service.

This concept is a cornerstone of the modern Federal Employees' Retirement System (FERS), which covers most of today's federal workforce. The system was intentionally designed with an MRA that gradually increases based entirely on your birth year.

The Sliding Scale of FERS MRA

The FERS system moved away from the old, fixed age-55 retirement option that many veterans of the federal service remember. Instead, it introduced this sliding scale.

For employees born before 1948, the MRA was 55. That age has been slowly climbing and will top out at 57 years old for anyone born in 1970 or later. So, for instance, if you were born in 1968, your MRA is 56 years and 8 months.

The table below breaks it all down, making it easy to pinpoint your exact MRA.

Find Your FERS Minimum Retirement Age (MRA)

If You Were Born...Your Minimum Retirement Age Is...Before 194855 yearsIn 194855 years and 2 monthsIn 194955 years and 4 monthsIn 195055 years and 6 monthsIn 195155 years and 8 monthsIn 195255 years and 10 monthsIn 1953 through 196456 yearsIn 196556 years and 2 monthsIn 196656 years and 4 monthsIn 196756 years and 6 monthsIn 196856 years and 8 monthsIn 196956 years and 10 monthsIn 1970 and after57 years

As you can see, for those born between the major cutoff years, the MRA increases in two-month increments.

But here’s the key takeaway: just reaching your MRA doesn't automatically mean you can retire with a full pension. It’s only one of two critical pieces of the puzzle. The other is your total years of creditable service. The combination of your age and service time is what truly dictates your retirement options.

Understanding your MRA is the essential first step. From here, you need to see how it pairs with your years of service to unlock different eligibility scenarios. We take a much deeper dive into all the possible combinations in our complete guide to federal retirement eligibility. Getting a handle on these rules is what empowers you to see the full picture and make truly informed decisions about your future.

FERS vs. CSRS: Two Different Worlds of Federal Retirement

If you’ve been around the federal government for a while, you've probably heard older colleagues talk about retiring at 55. But you’ll notice newer employees are always focused on a different term: their Minimum Retirement Age (MRA). This isn't just casual chatter; it highlights the massive difference between the two federal retirement systems: the Civil Service Retirement System (CSRS) and the Federal Employees' Retirement System (FERS).

Knowing which system you’re in is the absolute first step to figuring out your retirement timeline. CSRS, which covers most employees hired before 1984, is a powerful, standalone pension. It was designed to be your one and only source of retirement income from the government.

FERS, on the other hand, which covers nearly everyone hired since 1987, was built on a totally different idea.

FERS: The "Three-Legged Stool"

The best way to think about FERS is as a "three-legged stool." Your retirement stability depends on three separate income streams working together:

FERS Basic Annuity: This is your federal pension. It’s calculated using your years of service and your "high-3" average salary.

Social Security: Unlike folks in CSRS, FERS employees pay into Social Security and will receive those benefits when they retire.

Thrift Savings Plan (TSP): Your TSP is the government's version of a 401(k). It’s where your own contributions and the government's matching funds grow over your career.

This three-part structure is exactly why the minimum retirement age is such a huge deal for FERS employees. Hitting your MRA is what unlocks the first leg of that stool—your FERS pension—which is designed to work alongside your Social Security and TSP.

Why the Eligibility Rules Are So Different

Since CSRS was built to be a single, generous pension, its rules are much more straightforward. The whole concept of an MRA doesn't really apply. A CSRS employee can get a full, immediate retirement by meeting a simple age and service combo, like the classic age 55 with 30 years of service.

The Office of Personnel Management (OPM) is the ultimate authority on all these rules, and their website is an essential bookmark for any federal employee.

Just look at how OPM's website is set up. They have completely separate sections for FERS and CSRS. This confirms that even though they’re both "federal retirement," they operate under different rules, require different forms, and demand entirely different planning.

For FERS employees, the path isn't as clear-cut. Your ability to draw an immediate pension is tied directly to hitting your specific MRA—which could be anywhere from 55 to 57—and having the right number of service years to go with it.

The bottom line is this: CSRS is a single, robust pension with clear age goals. FERS is a three-part system where your MRA is the key that unlocks the pension piece of a much bigger retirement picture.

This single distinction explains everything. It's why one fed can confidently say, "I'm out at 55," while another is circling a specific date on the calendar two years later. It all comes down to when you were born and when you were hired—that determines the rulebook you have to follow.

Understanding Your FERS Retirement Pathways

Hitting your Minimum Retirement Age (MRA) isn’t the finish line—it’s the starting gate. Think of your MRA as a key that unlocks several different doors, each leading to a unique retirement path. Figuring out which door to open is one of the most important decisions you'll make, as it directly impacts your financial future and personal timeline.

The federal retirement system can feel like a maze, but it helps to know which set of rules you're following right from the start.

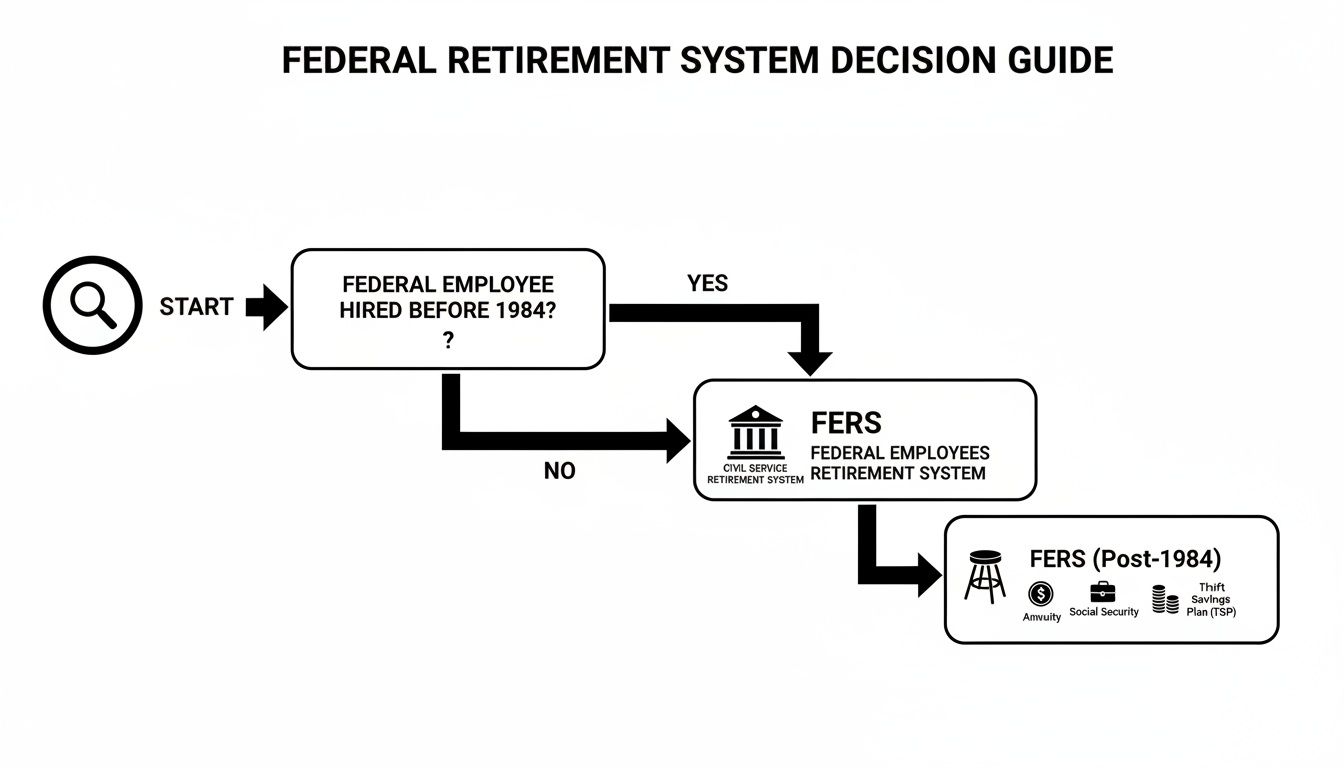

This chart shows that first big fork in the road: are you under the older Civil Service Retirement System (CSRS) or the modern Federal Employees Retirement System (FERS)?

Ultimately, your hire date is what sends you down one path or the other. It’s the single biggest factor that shapes your entire retirement strategy.

The Gold Standard: MRA with 30 Years

For most federal employees under FERS, this is the goal you circle on the calendar. If you reach your MRA (which is somewhere between 55 and 57) and you’ve put in at least 30 years of creditable service, you’ve hit the jackpot. You’re eligible for an immediate, unreduced retirement annuity.

This is the "gold standard" because you get your full pension without any penalties, and you can start drawing it at the earliest possible age. It’s the reward for a long, dedicated career in federal service.

The Popular MRA Plus 10 Option

So, what happens if you hit your MRA but you're not quite at the 30-year mark? This is where the MRA+10 provision comes in, and it's a very popular—but tricky—option. It allows you to retire once you’ve reached your MRA with at least 10 years of service but fewer than 30.

Here’s the catch: this flexibility comes at a steep price. If you take this option, your FERS pension is permanently reduced by 5% for every year you are under age 62. It’s a serious trade-off. This in-depth Govexec analysis breaks down exactly how those MRA+10 reductions are calculated.

A Quick Example of the MRA+10 Penalty

Let's say Sarah's MRA is 57. She has 15 years of service and decides she's ready to retire using the MRA+10 option. Because she is five years younger than 62, her pension gets hit with a permanent 25% reduction (5 years x 5% per year). That cut isn't temporary; it lasts for the rest of her life.

The MRA+10 option lets you leave federal service earlier, but that lifelong reduction in your pension is a massive financial decision. You’re essentially buying back a few years of freedom with a piece of your retirement income.

Other Key FERS Retirement Pathways

Beyond the MRA-based options, FERS has other straightforward paths to an unreduced, immediate pension. These are built around hitting a specific age with a certain amount of service.

Age 60 with 20 Years of Service: If you work until you’re age 60 and have at least 20 years of creditable service, you qualify for an immediate and unreduced pension. This is a common target for feds who started their government careers a little later in life.

Age 62 with 5 Years of Service: This is the final safety net for FERS eligibility. Once you hit age 62, you only need 5 years of creditable civilian service to lock in an immediate, unreduced pension. Your pension check will naturally be smaller with fewer years of service, but it won’t be hit with any age-based penalties.

Each of these pathways offers a different mix of age and service, giving you multiple ways to secure your federal retirement. The right one for you comes down to your career length, personal goals, and what you need financially.

Exploring Special Provisions and Early Retirement

While the standard MRA rules cover most federal employees, a special segment of the workforce plays by a different set of rules. These roles, often high-stress or physically grueling, fall under a category known as Special Provisions. This is a built-in recognition that careers in these fields are fundamentally different and deserve an accelerated retirement timeline.

Think of it as a retirement fast-track. Federal law enforcement officers, firefighters, and air traffic controllers, among others, don't have to wait until their late 50s. The system acknowledges the demanding nature of their work by offering a much earlier exit point.

This isn't some kind of loophole. It's a deliberate, thoughtful part of the federal retirement system designed to ensure these dedicated professionals can retire and enjoy their hard-earned benefits.

Faster Eligibility for Demanding Roles

The retirement formula for Special Provision employees is refreshingly direct and much more generous than the standard FERS rules. They can retire with a full, unreduced pension once they meet one of two conditions:

At age 50 with at least 20 years of covered service.

At any age with at least 25 years of covered service.

This framework is a game-changer, allowing for retirement far sooner than the standard MRA of 55 to 57. It’s a clear acknowledgment that a 30-year career looks very different from behind a desk than it does on the front lines.

Other Avenues for an Early Departure

Special Provisions aren't the only way to leave federal service ahead of schedule. Other situations can also open the door to early retirement, though they are usually based on specific circumstances rather than the type of job you have.

One of the most common scenarios involves a Voluntary Early Retirement Authority (VERA) offer, which is often sweetened with a Voluntary Separation Incentive Payment (VSIP), also known as a buyout.

VERA is a management tool that agencies can use to downsize or restructure. It isn't always available; it's a specific, limited-time window that lets eligible employees retire before they hit their normal age and service milestones.

If you want to dive deeper into how these offers work, check out our complete guide to voluntary early retirement. It breaks down the eligibility requirements and what you should consider if your agency makes you an offer.

Deferred and Disability Retirement Options

What happens if your career doesn't follow a straight line to retirement? Two other important pathways provide a safety net for those who leave service under different circumstances.

Deferred Retirement: This is for people who leave federal service with at least five years of service but before they are eligible for an immediate pension. If you leave your FERS contributions in the system, you can apply for a deferred pension later, usually once you turn 62.

Disability Retirement: If a medical condition prevents you from performing your job effectively, you may be eligible for disability retirement. To qualify, you must have at least 18 months of creditable civilian service.

Understanding all these provisions—from Special Provisions to VERA and deferred retirement—gives you a complete picture of your options. For more context on getting to your money early, it's also helpful to look at common early withdrawal penalty exceptions for other types of retirement accounts. Seeing the whole landscape helps you plan the best possible exit from your federal career.

Seeing It in Action: How Real Federal Employees Decide When to Retire

Okay, we've waded through the rules and tables. But let's be honest, that's all just theory. The real test is seeing how these rules play out for actual people making life-changing decisions. The complexities of the minimum retirement age for federal employees really click when you see them through someone else's eyes.

So, let's step into the shoes of a couple of FERS employees. One is feeling the burnout and eyeing the exit, even if it comes with a penalty. The other is playing the long game, determined to squeeze every last dollar out of their pension. Their stories really bring the trade-offs to life.

The MRA+10 Dilemma: Freedom vs. Finances

Let's meet "David." He's 57, just hit his MRA, and has 18 years of solid service under his belt. The problem? He's completely fried and ready for something new. He’s a textbook case for the MRA+10 retirement option—it lets him retire right now instead of grinding it out until age 60 (with 20 years) or 62 (with 5 years).

But here's the catch. This early escape hatch comes with a cost. Since David is five years shy of 62, his FERS pension will be permanently slashed by 25% (that's 5% for each year under 62).

David’s Thought Process: He pulls out a calculator and stares at the numbers. A 25% cut is a big pill to swallow. But then he thinks about his quality of life. His Thrift Savings Plan (TSP) is in good shape, and he has a line on some part-time work in a field he actually enjoys. For him, the smaller-but-sooner pension is a price he’s willing to pay for five extra years of freedom from a high-stress job. He decides to pull the trigger on the MRA+10 option.

David’s story is a perfect reminder that retirement isn’t just a math problem. It’s about making the numbers work for the life you want to live.

The "Maximize Everything" Strategist: Patience Pays Off

Now, let's turn to "Maria." She's 58 with an impressive 29 years of service. She’s just one year away from hitting the federal retirement gold standard: MRA with 30 years. For her, the choice is a no-brainer. Waiting just 12 more months unlocks an immediate pension with no age-based reductions.

But Maria isn't even stopping there. Her plan is to work until she's 62. Why on earth would she do that? Because every extra year boosts her "high-3" salary average and adds to her total service time. More importantly, there's a huge carrot waiting for her at age 62.

Under FERS, if you work until age 62 with at least 20 years of service, your pension multiplier gets a permanent 10% boost—jumping from 1% to 1.1%. That's a bigger check every month for the rest of your life.

Maria is playing chess, not checkers. She's willing to put in a few more years to build a financial fortress for a retirement that could last decades.

What the Data Shows: Most Feds Don't Rush for the Exit

These stories are great, but what does the big picture look like? Well, the data reveals a pretty clear trend: most federal employees work well past the first day they're eligible to retire.

Statistics from the Office of Personnel Management (OPM) tell the story. Back in fiscal year 2019, the average retirement age for Feds was 61.8. Fast forward to 2022, and it had climbed to 63.3 for FERS employees and a striking 65.9 for those under the old CSRS system. You can dig into the numbers yourself in the full OPM retirement trend analysis.

This tells us something important. For a huge number of federal workers, hitting their minimum retirement age is just a date on the calendar, not a finish line. Whether it's to max out a pension, grab that 1.1% multiplier, or simply because they enjoy their work, many choose to keep going, building an even stronger financial foundation for the future.

Your Next Steps in Federal Retirement Planning

Knowing the rules is one thing, but actually putting that knowledge to work is what builds a secure financial future. Moving from theory to practice is how you’ll truly take control of your federal retirement journey. Now that you have a better handle on your MRA, service requirements, and the various retirement provisions, you can start building a real, actionable roadmap.

This is where the rubber meets the road. It’s the point where you stop thinking in abstract dates and percentages and start creating a concrete strategy that lines up with what you actually want out of life after your federal career.

Creating Your Personal Action Plan

First things first: ground your plan in solid facts, not guesswork. A simple mistake in your service computation date or a misunderstanding of your eligibility can throw your entire plan off track. The best way to start is by creating a simple checklist to confirm your status and pull together the essential documents.

Here are a few things you can do today to get started:

Verify Your Service Computation Date (SCD): This date is the official starting line for your creditable service. Double-check it on your latest SF-50 to make sure it’s accurate.

Locate Your Official Personnel Folder (eOPF): Go into your eOPF, download the whole thing, and save it somewhere safe. This folder is the complete history of your federal career—an absolutely invaluable resource.

Review Your TSP Statement: Take a close look at your balance, how much you're contributing, and where your money is invested. For most FERS employees, the TSP is a massive piece of the retirement puzzle.

Estimate Your Future Pension: Don't just guess what your monthly annuity will be. Get a clearer picture of your potential income by using a good retirement calculator for FERS.

Moving From DIY Planning to Expert Guidance

Gathering your documents is a fantastic start, but making sense of it all is where things can get overwhelming. The rules around the minimum retirement age for federal employees, creditable service, and health benefits are notoriously complex and all tied together. Making the right call often requires understanding how one decision impacts everything else.

A personalized benefit review can shine a light on opportunities and risks you might never spot on your own. It translates the dense language of federal regulations into a clear projection of your future retirement income, helping you sidestep costly errors.

Remember, a solid retirement plan goes beyond just your pension. A truly comprehensive approach also means incorporating estate planning to protect your legacy. Getting expert guidance ensures all the pieces of your financial life work together, giving you the confidence to build a secure and comfortable retirement. After all, you’ve earned these benefits—they deserve a strategy to match.

Common Questions About Your Federal Retirement

As you start piecing together your federal retirement puzzle, a lot of questions are bound to pop up. It's completely normal. Getting clear, straightforward answers is crucial, especially when you're zeroing in on your minimum retirement age for federal employees.

Let's tackle some of the most frequent (and important) questions that come up when planning your transition out of federal service.

Can I Keep My Health Insurance if I Retire at My MRA?

Yes, absolutely—if you meet one critical requirement. It's called the "five-year rule," and it's non-negotiable. To carry your Federal Employees Health Benefits (FEHB) into retirement, you must have been continuously enrolled in an FEHB plan for the five years immediately before you retire.

It doesn’t have to be the same plan for all five years, but the coverage must be continuous. If you miss this, you could lose your FEHB for good. Think of it as a final checkpoint before the finish line; make sure you've verified your enrollment history long before you submit your retirement papers.

What Exactly Is "Creditable Service"?

Think of creditable service as the official time on the clock that counts toward your retirement. It’s what the government uses to determine both when you can retire and how much your pension will be. For most feds, this is simply the time you've spent in your civilian job.

But it can get a little more complex. Other types of service can sometimes be added to your total:

Military Service: If you served in the military, you can often "buy back" that time by making a deposit. This adds those years to your creditable service.

Unused Sick Leave: Here's a key distinction: your leftover sick leave gets added to your service time to make your pension calculation bigger, but it cannot be used to meet the minimum years of service needed to be eligible to retire.

Knowing your total creditable service is just as important as knowing your MRA. You have to meet both the age and service requirements to get that immediate, full pension. Your HR office can give you your official Service Computation Date (SCD) to confirm your numbers.

What Happens if I Leave Federal Service Before I'm Eligible to Retire?

If you leave your federal job before hitting your MRA and service requirements, you might be eligible for what's called a "deferred retirement." This option is available if you have at least five years of creditable civilian service and you leave your retirement contributions in the system instead of taking a refund.

You can then file the paperwork to start receiving your pension payments later on, usually once you turn 62. But there's a huge catch: deferred retirement almost always means you forfeit your eligibility to continue your FEHB and federal life insurance (FEGLI). Losing those benefits is a massive financial hit, so think very carefully before leaving federal service early.

Planning your federal retirement is about more than just hitting a date on the calendar—it's about setting yourself up for a secure and confident future. At Federal Benefits Sherpa, we untangle these complex rules for federal employees every day. A free 15-minute benefit review can bring the clarity you need to protect your benefits and retire without worry. Learn how we can guide you to a stress-free retirement.