A Clear Guide to Thrift Savings Plan Withdrawal Rules

When it comes to your Thrift Savings Plan, knowing the withdrawal rules is just as important as knowing how to contribute. These rules dictate when and how you can tap into your hard-earned retirement savings, with a completely different set of guidelines for active employees versus those who have left federal service.

The main ways to get your money out are through lump-sum payments, a series of installment payments, or by purchasing an annuity. Each choice comes with its own tax consequences and timing requirements, so getting it right is crucial for making the most of your federal retirement.

Your Guide to TSP Withdrawal Rules

Think of your TSP account as a financial reservoir you've painstakingly filled throughout your career. The withdrawal rules are the gates and valves controlling that reservoir. Open them the right way, and you'll have a steady, reliable flow of income to support your life after work. Make a mistake, and you could drain your savings too quickly or get hit with surprise taxes and penalties.

This guide will serve as your map to those controls. The first and most critical fork in the road depends entirely on your employment status. The options you have while still on the federal payroll are worlds apart from what becomes available after you’ve separated.

In-Service vs. Post-Separation Withdrawals

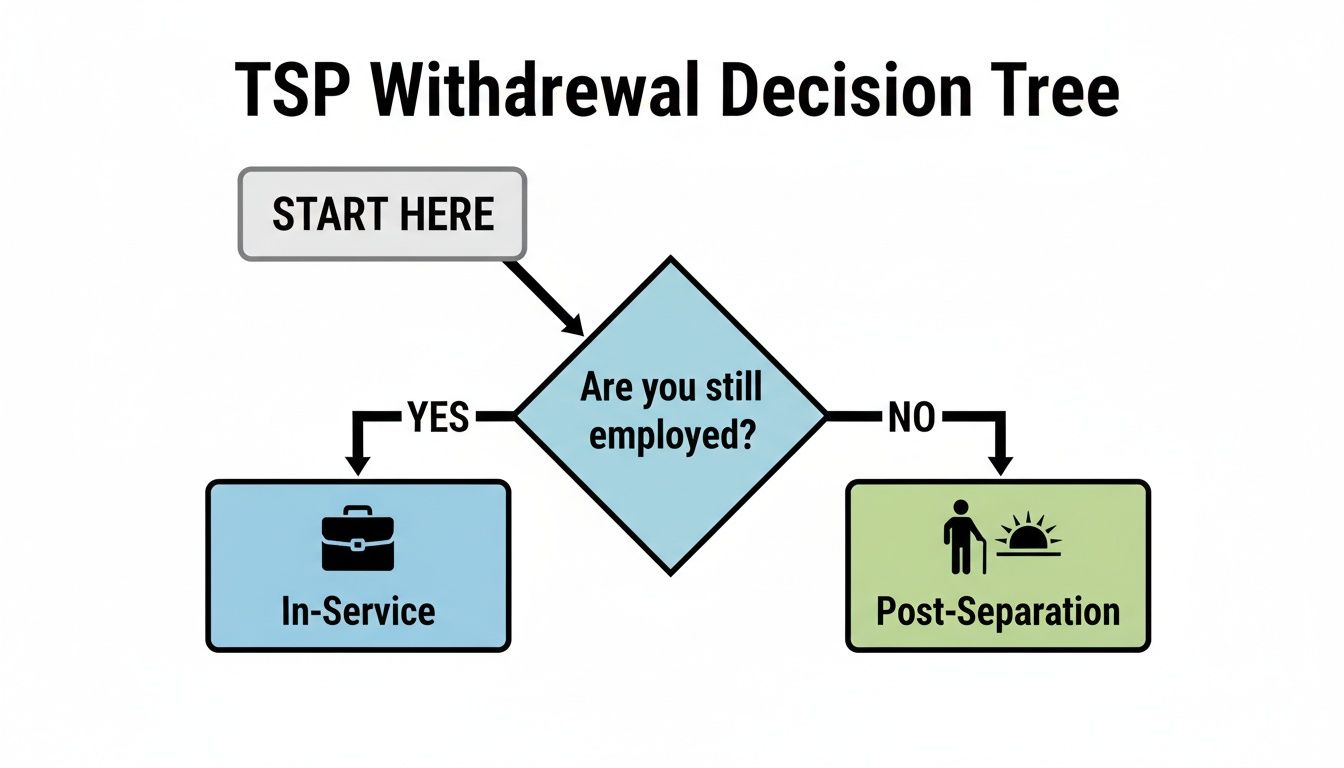

The first question is simple: are you still a federal employee? Your answer sends you down one of two very different paths, each with its own set of rules, limitations, and opportunities. This is the starting point for every decision you'll make about your TSP money.

The flowchart below visualizes this crucial first step.

As you can see, your entire withdrawal journey begins with your job status, which determines whether you'll be looking at in-service rules or the much broader post-separation options.

Key Takeaway: Your employment status is the single biggest factor determining which TSP withdrawal rules apply to you. In-service withdrawals are limited and meant for specific, often urgent, needs, while post-separation withdrawals unlock the full suite of options for creating your retirement income.

To give you a better sense of these two paths, here’s a quick summary table outlining the main withdrawal types and when you can access them.

TSP Withdrawal Options at a Glance

Withdrawal TypeWhen It's AvailableCommon Use CaseFinancial HardshipIn-Service (while employed)To cover a documented, urgent financial need.Age-BasedIn-Service (while employed) at age 59½To access funds for any reason without penalty before retiring.Lump-SumPost-Separation (after leaving service)To roll over funds to an IRA or take a one-time cash distribution.Installment PaymentsPost-Separation (after leaving service)To create a regular, predictable income stream from your TSP.AnnuityPost-Separation (after leaving service)To purchase a guaranteed lifetime income stream from a third-party provider.

This table provides a high-level look, but let's briefly define what each path entails.

In-Service Withdrawals: These are available to you as a current federal employee but only under specific circumstances. Think of them as emergency hatches. They're primarily for documented financial hardships or for older employees (age 59½ and up) who need access to some of their funds before retiring. They are absolutely not designed to be a source of regular income.

Post-Separation Withdrawals: This is where the real retirement planning begins. Once you retire or otherwise leave federal service, you gain full, flexible access to your TSP. You can now choose how to convert that nest egg into a paycheck, whether through single payments, a series of installments, or a life annuity.

Getting this fundamental concept down is the first step toward making smart, confident decisions about your TSP.

How to Structure Your Post-Separation Withdrawals

Once you’ve left federal service, the game changes completely. The limited, emergency-focused rules for taking money out of your TSP while you’re still working are a thing of the past. Now, you get access to the full toolkit of thrift savings plan withdrawal rules, which are all about turning that nest egg you've built into a reliable retirement income. This is the moment all that diligent saving was for.

Think of your TSP account like a reservoir you've been filling up throughout your career. Now you have to decide how to open the taps to keep you going for the rest of your life. You’ve basically got three main options: you can open the floodgates all at once, set up a steady, predictable stream, or install a system that guarantees a flow of water for life by buying an annuity.

Each of these strategies serves a very different purpose. The right one for you really depends on your financial picture—your goals, how you feel about risk, and what other income you’ll have, like your FERS pension and Social Security.

Option 1: The Lump-Sum Withdrawal

A lump-sum withdrawal is exactly what it sounds like: you take out a specific amount, or even your entire account balance, in one shot. It’s the "drain the reservoir" approach. This gives you immediate access to a big chunk of cash, which can be tempting if you want to pay off your mortgage, buy a vacation home, or dive into a new investment.

But you have to be careful here. Taking a massive distribution can easily bump you into a much higher tax bracket for the year, meaning a bigger tax bill than you were expecting.

Important Consideration: If you take a single payment of more than $200 that is eligible to be rolled over, the TSP is required by law to withhold 20% for federal income tax if the check is made out to you. That’s a critical piece of the puzzle when you’re planning your cash flow.

A lot of federal retirees use a lump-sum payment not to spend the money, but to move it. A very common strategy is to do a direct rollover from the TSP into an Individual Retirement Account (IRA). If you're curious about that, our team put together a guide on how to rollover your TSP to an IRA that walks you through everything. This move lets you avoid the immediate tax hit and often opens up a much wider world of investment options.

Option 2: Installment Payments

If you’d rather have a predictable, steady income coming in, then installment payments are a fantastic choice. This is like opening a spigot on your reservoir just enough to create a consistent, manageable flow. The TSP gives you a ton of flexibility here, letting you set up payments based on either a specific dollar amount or your life expectancy.

You can choose to get these payments monthly, quarterly, or even just once a year. That level of control helps you match your income to your actual living expenses.

Here’s a quick rundown of how the two types of installment payments work:

Fixed Dollar Amount: You tell the TSP you want a specific amount, say $2,000 per month. You'll keep getting that amount until your account runs out. The best part is you can change the amount or stop the payments whenever you need to.

Life Expectancy-Based Payments: This is a bit different. The TSP uses an IRS life expectancy table to calculate a payment amount for you each year, based on your age and account balance. The goal is to stretch your money over your entire estimated lifetime.

With this approach, the bulk of your money stays right where it is—invested in the low-cost TSP funds—and continues to have the potential to grow, all while you get the regular income you need.

Option 3: The TSP Life Annuity

Your third choice is to use some or all of your TSP balance to buy a life annuity from MetLife, the TSP's current provider. This is the ultimate "set it and forget it" strategy for income that you absolutely cannot outlive. You're essentially trading a chunk of your savings for a contract that promises you a monthly check for the rest of your life (and your spouse's, if you choose).

That guarantee can provide an incredible amount of peace of mind. You simply can't outlive an annuity income stream.

You can also add a few bells and whistles to customize it:

Single Life vs. Joint Life: Payments can be set up to last for just your lifetime or for as long as either you or your spouse is living.

Increasing Payments: You can choose an option where your payments go up by a set percentage each year, which helps your income keep pace with inflation.

Cash Refund or 10-Year Certain: These features are a safety net. They make sure that if you (and your spouse) pass away sooner than expected, a beneficiary gets either a lump sum or continued payments for a guaranteed period.

Just know that buying an annuity is an irreversible decision. Once you hand over the money, you can't get it back. It can be a powerful way to build a secure income floor for your retirement, but it also means you give up control and potential growth on that portion of your money for good.

Tapping into Your TSP While You’re Still on the Job

Your Thrift Savings Plan is meant to be your nest egg for retirement, but sometimes life happens and you need cash sooner than planned. While the withdrawal options open up significantly once you separate from federal service, the thrift savings plan withdrawal rules for current employees—what we call in-service withdrawals—are much tighter.

Think of these as emergency hatches, not front doors. They're designed for very specific, and often urgent, situations.

Dipping into your TSP while you're still working is a big decision with real consequences for your future retirement income. It's not something to do on a whim. That said, knowing your options is half the battle. There are really two main ways you can access your money while still employed: a financial hardship withdrawal or an age-based withdrawal once you hit 59½.

When You're Facing a True Financial Hardship

A financial hardship withdrawal is exactly what it sounds like—a last-ditch option when you're facing a serious, immediate financial crisis. The TSP doesn't take this lightly, and you'll have to prove your case. This isn't for a kitchen remodel or a dream vacation; it's for genuine emergencies.

The TSP has a very specific list of what qualifies. You can request a hardship withdrawal for one of these documented reasons:

Negative Monthly Cash Flow: You have to show that your regular expenses are consistently more than your income.

Major Medical Bills: This can cover uninsured costs for you, your spouse, or your dependents.

Personal Casualty Losses: This applies to significant, uninsured losses from disasters like a house fire or a flood.

Legal Fees for a Divorce: This is limited specifically to costs associated with a legal separation or divorce.

It's crucial to understand the strings attached. A hardship withdrawal is not a loan. Once you take that money out, it's gone for good, and so is all the potential growth it would have generated over the years. Even worse, taking one will lock you out of making TSP contributions for a period of time, which also means you'll forfeit any agency matching funds. If you're considering this, you might first want to check out this guide to borrowing from your TSP, which is a different animal altogether.

The Magic Number: Age 59½

Everything changes once you reach age 59½. At this point, a new door opens, allowing you to take an "age-based" in-service withdrawal for any reason at all—no hardship required. This offers a ton of flexibility while you continue to work and contribute. You can take up to four of these withdrawals each calendar year.

This is a fantastic tool for employees who might want to pay down a high-interest loan, help with a child's wedding, or tackle a big home project without completely derailing their retirement plan. Best of all, because you're over 59½, you completely sidestep the nasty 10% early withdrawal penalty that usually applies to pre-retirement distributions.

Key Insight: The age-based withdrawal at 59½ is a powerful tool. It allows you to access your TSP funds without penalty while still employed, giving you a level of financial flexibility unavailable to younger employees.

Of course, Uncle Sam still wants his cut. Any money you pull from your traditional TSP balance will be taxed as regular income for that year. If you take out a large sum, be careful—it could easily bump you into a higher tax bracket.

No matter the reason, remember that the TSP has a minimum withdrawal amount of $1,000. These rules are in place for a reason, as taking money out too early can seriously impact your long-term financial health. You can find all the nitty-gritty details in the official TSP annual report if you want to dive deeper.

Ultimately, you need to weigh these options carefully. While in-service withdrawals provide a crucial safety net, your number one goal should always be to protect and grow that TSP balance for a comfortable and secure retirement.

Navigating Taxes and Penalties on TSP Withdrawals

Taking money out of your Thrift Savings Plan is a big moment, but the amount you ask for isn't always what lands in your bank account. Getting a handle on the tax rules and potential penalties is absolutely critical for making smart decisions. This is where the thrift savings plan withdrawal rules get serious, because one wrong move could leave you with a surprisingly large tax bill.

Think of Uncle Sam as a silent partner in your traditional TSP. For years, you got a tax break on every dollar you contributed and all the earnings it generated. When you finally pull that money out, it's time for the government to collect its share. Of course, this all works a bit differently depending on whether your money is in a traditional or Roth account.

Traditional vs. Roth TSP Tax Treatment

The way your TSP withdrawals are taxed comes down to one simple thing: which type of account did you contribute to? Your Traditional and Roth balances are treated very differently by the IRS, which directly impacts how much cash you actually get to keep.

Traditional TSP: Any money you withdraw from your traditional balance—your contributions, agency matching funds, and all the investment earnings—is taxed as ordinary income for the year you take it.

Roth TSP: Withdrawals from your Roth TSP balance are completely tax-free, but only if you meet two key conditions. First, you have to be at least age 59½. Second, at least five years must have passed since January 1st of the year you made your very first Roth contribution.

This clear difference is exactly why many federal employees contribute to both accounts. It gives them more flexibility to manage their taxable income once they're in retirement.

Avoiding the 10% Early Withdrawal Penalty

One of the steepest costs you can face is the 10% early withdrawal penalty. If you take money from your TSP before you turn 59½, the IRS generally tacks this on top of your regular income tax.

But there's good news. Federal employees have a few powerful exceptions to this rule. You can avoid the 10% penalty if:

You leave federal service during or after the year you turn 55.

You're a public safety employee (like a law enforcement officer or firefighter) and you separate from service in the year you turn 50 or later.

Your withdrawal is because of a total and permanent disability.

A beneficiary is taking the withdrawal after your death.

Key Insight: That "age 55" rule is a huge benefit for federal retirees. It lets you tap into your TSP penalty-free much sooner than the rules for a typical 401(k) allow, as long as you leave your job in or after the year you hit that milestone. To learn more, take a look at this great guide to early withdrawal of TSP funds.

How Different TSP Withdrawals Are Taxed

To make things clearer, let's look at a few common scenarios. The table below breaks down how taxes and penalties might apply depending on the situation.

Withdrawal ScenarioTax on Traditional FundsTax on Roth FundsPotential 10% PenaltySeparated at age 56, taking installment paymentsTaxed as ordinary incomeTax-free (if 5-year rule met)No, separated after age 55.Still working at age 60, taking in-service withdrawalTaxed as ordinary incomeTax-free (if 5-year rule met)No, over age 59½.Separated at age 52, taking a lump-sum withdrawalTaxed as ordinary incomeTaxed as ordinary income on earningsYes, unless you are a qualifying public safety employee.Disability retirement at age 45Taxed as ordinary incomeTaxed as ordinary income on earningsNo, due to total and permanent disability exception.

As you can see, your age, employment status, and the reason for the withdrawal all play a major role in the final financial outcome.

Mandatory Withholding and Rollovers

When you request certain types of withdrawals, the TSP is legally required to withhold a chunk for federal taxes before the money ever leaves their hands. For any single payment or lump-sum withdrawal that's eligible to be rolled over, the TSP must withhold a flat 20% for federal income tax.

This can be a real shock if you're not ready for it. For instance, if you request a $50,000 lump sum, you'll only get a check for $40,000. And remember, that 20% is just a down payment on your total tax bill—your actual tax rate could be higher or lower.

The easiest way to sidestep this mandatory withholding is to do a direct rollover. By having the TSP transfer your funds straight into another retirement account, like an IRA, no taxes are withheld. The money just keeps growing tax-deferred in its new home.

While your TSP benefits are designed to pass directly to your beneficiaries and avoid probate, it's helpful to understand the broader context of estate planning. Learning about how IRAs and 401ks are handled during the probate process can provide valuable insight. Ultimately, planning your withdrawals and rollovers carefully is the key to keeping more of your hard-earned money.

Understanding Required Minimum Distributions

Just when you think you have complete control over your TSP, Uncle Sam comes knocking with a rule you simply can't ignore: the Required Minimum Distribution, or RMD.

Think of it as the government's way of saying, "You've had a great run letting this money grow tax-deferred, but now it's time for us to get our share." Your TSP is absolutely subject to this rule, making it a critical piece of the puzzle for managing your retirement withdrawals.

An RMD is the minimum amount of money you must withdraw from your retirement accounts each year after you hit a certain age. It's not a suggestion; it's a federal mandate. Forgetting about it can lead to some pretty painful financial consequences.

When Do RMDs Begin?

The starting line for RMDs has shifted a few times over the years, so it's vital to know which age applies to you. Recent laws have pushed the age back, which is great news as it gives your investments a little more time to grow untouched.

Here’s a quick rundown based on the year you were born:

Born in 1950 or earlier: You should already be taking your RMDs.

Born between 1951 and 1959: You must start taking RMDs at age 73.

Born in 1960 or later: Your RMDs will begin at age 75.

So, if you were born in 1951, your first RMD is due by April 1 of the year after you turn 73. After that first one, all subsequent RMDs must be taken by December 31st each year.

How the TSP Calculates Your RMD

The good news is you don't have to break out the spreadsheets and calculators. The TSP does all the heavy lifting for you.

Every year, they’ll calculate your RMD automatically. They do this by taking your traditional TSP account balance from December 31 of the previous year and dividing it by a life expectancy factor from the IRS's Uniform Lifetime Table.

Here's a crucial point: RMDs only apply to your traditional TSP balance. Your Roth TSP funds are exempt from RMDs for you, the original account owner. This is a massive advantage of the Roth TSP, as it lets that money keep growing tax-free for your entire life without forcing you to take it out.

The penalty for failing to take your RMD is one of the harshest in the entire tax code. If you miss the deadline or don't withdraw enough, the IRS can hit you with an excise tax of 25% on the amount you were supposed to take out.

Thankfully, the TSP has a built-in safety net. If you haven't withdrawn your full RMD amount by the December deadline, they will automatically send you a payment for the remaining balance. While this is a fantastic feature that can save you from a costly mistake, nothing beats proactive planning to manage your retirement income and tax situation on your own terms.

A Step-by-Step Guide to Making a TSP Withdrawal

Alright, you've got a handle on the rules. Now it's time to put that knowledge into practice and actually get your money. Let's walk through exactly how to initiate a TSP withdrawal, step-by-step, so you can feel confident you're doing it right.

Thankfully, the entire process is handled online through the TSP's secure "My Account" portal. Forget stacks of paperwork; it's all done digitally now.

Kicking Off Your Withdrawal Request

First things first, you'll need to log in to your account on the official TSP website. Once you're in, find the withdrawals section. The system is pretty smart and will immediately show you the options you're eligible for based on whether you're still working or have already separated from federal service.

You'll start a new request, which will trigger a series of questions—think of it as a guided interview to make sure you've covered all your bases. You’ll have to make a few key decisions right away:

What kind of withdrawal is this? Are you taking a one-time lump sum, setting up a series of monthly payments, or maybe pulling out funds through an age-based in-service withdrawal? The system will only show you what you're allowed to do.

How much do you need? You'll enter the specific dollar amount you want to take out.

Where is the money coming from? If you have both Traditional and Roth balances, you need to decide whether to pull from one, the other, or a proportional mix of both.

This first part is all about telling the TSP what you want to do.

Nailing Down the Details

Once you've defined the basics, the online tool will ask for the logistical details. This is where you decide how the money gets into your bank account and how you want to handle the initial tax bite.

You’ll need to provide your bank's routing and account numbers to set up direct deposit—it's by far the fastest and safest way to get your money. Then comes taxes. The system will tell you the default federal withholding rate, which is often 20% for lump-sum distributions, but you'll have the option to change it to better fit your personal tax strategy.

A Quick Heads-Up for Married FERS Employees: Don't forget about spousal consent. For almost any withdrawal you make, your spouse will have to formally sign off on it. This is a built-in protection to make sure both partners are on the same page about major financial moves.

The online system makes this easy, usually with a simple electronic signature from your spouse. While you can still use paper forms like the TSP-99 (Withdrawal Request for Separated and Beneficiary Participants), nearly everyone handles these transactions online now.

After a final review to make sure every detail is correct, you'll submit the request. From there, you can track its progress right from your TSP account dashboard.

Your Top TSP Withdrawal Questions, Answered

When you start digging into the details of your retirement plan, a lot of questions bubble up. It's completely normal. Let's tackle some of the most common questions federal employees have about the thrift savings plan withdrawal rules so you can plan your next steps with total clarity.

Can I Leave My Money in the TSP After I Retire?

Yes, you absolutely can. There's no rule forcing you to move your money the day you separate from federal service.

In fact, many retirees keep their money right where it is. Why? The TSP is well-known for its incredibly low administrative and investment fees, which can save you a significant amount of money over the long haul.

Your account will keep growing based on the funds you've chosen, and you'll still have full online access to manage your investments. You can even consolidate other retirement accounts, like a 401(k) or traditional IRA, by rolling them into your TSP.

How Many Withdrawals Can I Make After Retirement?

This is where things have gotten much better for federal retirees. Thanks to the TSP Modernization Act, the old, rigid rules are gone. After you've separated, you can take as many withdrawals as you need.

The only real catch is that you have to wait at least 30 days between each withdrawal request. This flexibility means you can adapt to life's changing needs without being locked into a single choice you made at the start of retirement.

Key Takeaway: You're no longer stuck with a one-time lump-sum withdrawal or a fixed set of payments. The modern rules give you the freedom to mix and match withdrawals to fit your life.

What Happens to My TSP If I Pass Away?

Your TSP funds will go directly to the beneficiaries you named on your Form TSP-3, Beneficiary Designation. It is absolutely critical to keep this form updated, especially after big life changes like a marriage, divorce, or a new baby.

If you don't have a valid form on file, the TSP follows a standard order of precedence, which means your money will go to your spouse first, then children, and so on. Don't leave it to chance—make sure your wishes are clearly documented.

Financial planning also means considering worst-case scenarios. For example, it's wise to understand how retirement savings are treated in Chapter 13 bankruptcy to protect your assets.

Can I Still Take a Loan From My TSP After I Retire?

No, this option disappears once you leave federal service. TSP loans are a benefit exclusively for active employees.

After you separate, your only way to access your money is through the withdrawal options we've discussed, like installment payments or one-off single withdrawals.

Getting a handle on these rules is the first step toward a retirement you can feel good about. At Federal Benefits Sherpa, our specialty is guiding federal employees through the complexities of their benefits. Book a free 15-minute benefit review and let us help you map out a clear path to your financial future.